I met Peter Cashion, Managing Director, Sustainable Investments, while doing research for my piece “The Evolution Of Sustainable Investing At CalPERS.” We touched on what CalPERS is doing today in terms of sustainable investing, but I wanted to get into more detail. I asked Peter if he’d be willing to do an interview with me so we could do so, and he kindly agreed.

Peter Cashion, Director Sustainable Investments, CalPERS

Eccles: Peter, thanks for taking the time to talk to me. You’ve only recently joined CalPERS. How did that happen?

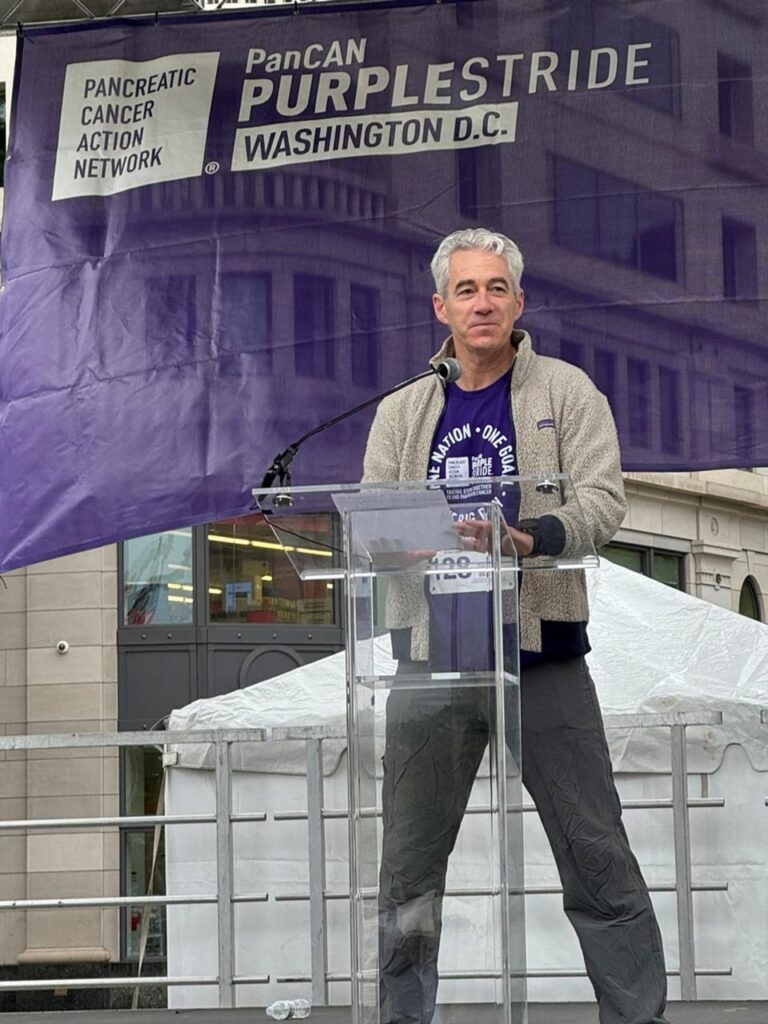

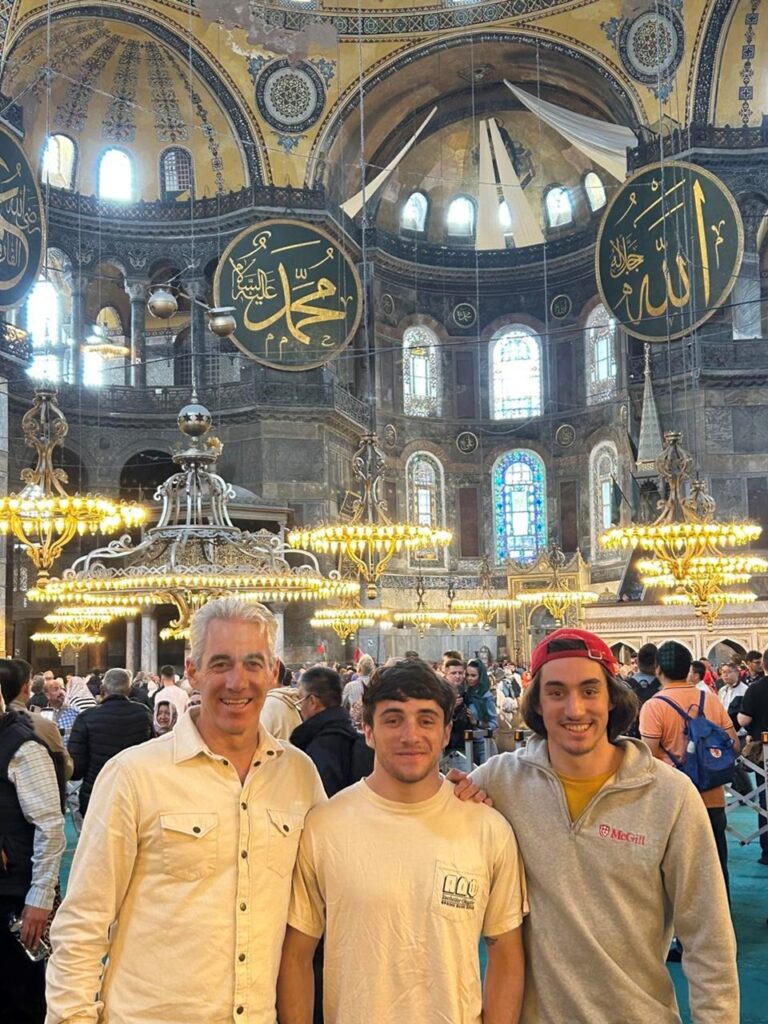

Cashion: Yes, I’ve only been at CalPERS for about 18 months now and it’s been amazing and intense. Prior to this, I spent almost 30 years at the International Finance Corporation (IFC), which is part of the World Bank Group, in Washington D.C. I’m a proud Canadian/American; I grew up in Canada but have spent most of my working life in the U.S. and abroad. I’m always up for an adventure and have lived in Dhaka, Dakar, Abidjan and Istanbul and now Sacramento. I have two boys in their 20s, one in New York and one in Montreal, who are working and studying. I’ve been a solo parent for the past decade as I lost my wife to pancreatic cancer. This was incredibly hard and traumatic, but we fight back against the disease through fundraising to support research and I’m on the Board of the Pancreatic Cancer Action Network.

PurpleStride 5 KM fundraiser in Washington DC with my two boys (Garrett – left; Luke – right). We launched Team Andra 11 years ago in memory of my late wife to support pancreatic cancer research. APRIL 2021

Eccles: That is a real tragedy indeed and I’m sorry to hear that but good to hear about what you’re doing as a result. Mind telling me a bit about your childhood?

Cashion: For starters, I guess I’d have to say that I might have never happened! My dad was originally in the seminary and my mom was a nun. Fortunately, they didn’t continue their career path, and I was born in Boston, Massachusetts. When I was young my parents wanted to move out of the city and get back to nature, so we headed to New Brunswick, a small Canadian province that’s east of Maine. We lived in Fredericton, a small university town along the St. John River. It was a great place to grow up. I spent a lot of time outdoors and played all types of sports.

When I graduated from high school, I enrolled in the University Western Ontario, where I was able to make the basketball team as a walk-on. Now I never played that much, and I probably committed more fouls than I scored points, but we were a really good team and had some big success. When we do icebreakers, like two truths and a lie, I sometimes say “I made it to the college basketball’s Elite Eight…” But in Canada.

Eccles: How did you go from growing up in a family with strong religious ties, to loving sports, to investing? What led you into the world of business and finance?

Cashion: Yeah, well, I opted to not follow religion as my career and my parents were biochemistry and education professors, and that didn’t spark my interest. I was pretty keen from a young age on getting involved in finance and business. That was really the motivation for going to Western, which has one of the leading business schools in the country. When I was there, I really became interested in what’s happening in developing countries and the whole development and impact side of things. The term “impact investing” wasn’t used back then, but that’s what I was interested in pursuing.

Giving a speech at the PurpleStride 5 KM fundraiser in Washington DC for the Pancreatic Cancer Action Network. APRIL 2024

Eccles: Well, finance isn’t religion, but I can see your parents’ genes coming through.

Cashion: I guess so!

While at Western I took a bit of contrarian path as I was accepted to the Ivey Business School, but instead opted to focus on development economics and graduated in three years, much to the chagrin of my parents. Also to their chagrin and surprise of my friends, I wanted to backpack around the world. With my roommate and travel partner, I crafted our global itinerary. But right before we were set to depart, my friend pulled out on me! So even though I had never set foot outside of eastern North America, I said “I’m going to do it!” That turned out to be a key reason why I am sitting here today. The trip showed me how much potential there is in the world, particularly in developing countries, where poverty and underdevelopment are holding so many people back. That’s when I really thought, “How can I combine my studies and interest in finance with development and impact investing?”

Eccles: What did you do when you got back from wandering around the world?

Cashion: I went to Queen’s University in Ontario to get my MBA. But when I graduated, I couldn’t find a job, so I ended up in Dhaka, Bangladesh (of all places!) where I had a Fellowship with the Bangladesh Rural Advancement Committee for a year doing microfinance. The job allowed me to see firsthand how finance can impact some of the poorest people in the world, particularly women, and that really cemented my interest in doing more in this area. I had the good fortune to meet my future wife in that overseas program, so it was a double win.

When I came back home, I got the job at IFC in Washington, D.C.

Eccles: Let’s talk about that. The IFC was the first big job you got out of college. How did your time there shape your interest in climate change and what were you able to accomplish?

Cashion: IFC has really been a leader in terms of impact investing and environmental, social, and governance, or ESG. We started implementing ESG back in the late 90s. At that time, I was an investment officer living in West Africa just struggling to get deals done, I was really an ESG skeptic because I saw this as just one other headache and hurdle to get in the way of getting a deal done, and it was already hard enough to get stuff done there. However, after about a year I realized that this is actually an important tool to reduce risks and identify opportunities – and our clients realized the value as well.

Eccles: How so?

Cashion: Here’s an example. Around 2005 we started doing energy efficiency investments in Eastern Europe and we really created that whole industry in the region. There were all these ex-Soviet era buildings, installations, and factories that were not energy efficient at all, and there were enormous gains that could be realized. A few years later, I was living in Turkey, and I leveraged that earlier experience to do multiple, large-scale renewable investments to promote the decarbonization rollout in Eastern and Central Europe.

By 2018, I had become the global head of climate finance and chief investment officer for IFC’s Financial Institutions Group (FIG). We accounted for about half of IFC’s investment volume, and climate solutions made up about 40% of that number, so it was a meaningful share that had grown significantly during my time there. All of this further convinced me of the business case and the potential profit around climate financing.

Hot air ballooning in central Turkey as part of our ‘return home’ visit to Turkey. MAY 2023

Eccles: With all that said, what compelled you to pull up stakes and move across the country to CalPERS?

Cashion: That’s a good question. It was a big move, but after the pandemic and 28 years at IFC, I was ready for the next big thing and CalPERS really had all the elements that I was seeking in my next role. First, it was leaning into sustainability and climate in a big way. Second, it was an enormous platform. Finally, it had great conviction from the Board to the CEO to the CIO, and already had an experienced and seasoned team doing sustainability and stewardship. So everything just aligned. And, yeah, I was really excited to make the big move out here18 months ago. Frankly, if I couldn’t have scripted it to go any better than I think it’s gone so far. It’s been a really great experience and journey so far.

Eccles: Glad to hear it! We’ll get to what you’re doing at CalPERS right now in a bit. But what was the state of climate investing there when you arrived?

Cashion: CalPERS has a long and very strong history in ESG, in sustainability, in governance, and in stewardship. On the stewardship side, we helped found Climate Action 100+. On the ESG side, we had set up the first-ever Data Convergence Project with Carlyle. So, CalPERS really had a strong history, but the climate investing piece was still underdeveloped. That was what I really wanted to lean into, along with deepening the ESG integration into the investment process.

During my first eight months we worked to come up with a strategy, and we presented it to the Board last November. It was centered around the simple question of “What do we want to do between now and the end of 2030?” Whether it is climate, engagement, ESG, advocacy, etc., what are our goals for the next seven years?

And that’s how we developed CalPERS’ $100 Billion Climate Action Plan.

Eccles: I have heard you refer to this as one of the biggest climate commitments of any allocator in the world, but what are you hoping to achieve? What do you see in this space?

Cashion: The shorthand way to describe our plan is with three keywords: (1) $100 billion, (2) Resilience, and (3) Equity. On the first point, CalPERS is seeking to have $100 billion invested in climate solutions by the end of 2030. We’re starting at a base of about $47 billion, so we are looking to more than double our investments in this space. We’re doing it with the prime motivation to generate alpha or outperformance. While these investments will reduce emissions, this is more of a consequence of the plan, not the main driver. The primary driver here is returns and fulfilling our fiduciary duty to our 2.2 million members.

On the resilience point, we are furthering our ESG integration in the investment process and by incorporating a climate risk scenario analysis from a top-down portfolio level.

Finally, in terms of equity we’re very involved in identifying and promoting diverse and emerging managers, as well as having a very active engagement with stakeholders and advocacy with regulators to ensure that there’s equity there. We also have very active human capital management, including our recent labor principles that were announced last year.

Eccles: What does “emerging managers” mean to you?

Cashion: We’re looking to identify and support the next generation of asset managers who have a unique niche and market access that allows them to outperform – and that may otherwise be overlooked. An emerging manager may be someone who may be on their first or second fund who identifies an opportunity that has a strong potential for success. We are often a seed investor and may take a stake in the management company, and the manager can also leverage our name, which helps on fundraising and access.

Eccles: I’ve heard you refer to climate change as the next revolution or mega-trend. Tell me what you mean?

Cashion: Sure. We really see climate change and decarbonization response as an economic revolution that will perhaps be the biggest in our history, surpassing what we saw with past economic revolutions brought about by coal, oil and gas, and now technology. Imagine getting in on the ground floor of each of those opportunities. Everyone would love to have been able to invest in the companies that became groundbreaking game-changers when they were first available. Fast forward to today and we’re seeing a transformation that’s going to equal, if not exceed, those and it’s going to play out over an even longer time. It’s critically important to be aware of the impacts, both the positive and negative ones, and the opportunities along with risks.

When it comes to investing in climate solutions, we see these opportunities falling into three categories. The first is mitigation, so think about investing in renewable energy sources like solar, wind, hydro, and other sources that will meet the world’s increased demand for power while relying less on fossil fuels.

The second opportunity is in adaption where we invest in companies that are adapting to our changing world. These could be water management systems that ensure a clean and stable supply, drought-resistant crops, and early-warning systems to reduce the damage caused by natural disasters.

Finally, there’s transition where we help high emitters reduce their emissions through new technologies (e.g., green steel) or moving power utilities to renewable energy sources. In the private markets this is through direct investments. In the public markets it is more through engagement and investing in companies with decarbonization plans we believe will reduce risk and create value over the long term.

We visited Istanbul last year for my son’s graduation after living in Turkey 10 years prior – a homecoming of sorts. Hanging in the Hagia Sophia. MAY 2023

Eccles: How does CalPERS implement this, what’s the plan?

Cashion: First, we’ve worked super closely with each of the asset classes at CalPERS to identify new climate investment opportunities, both on the public and private side. Second, we’re in the midst of hiring 10 people into my team, so doubling in size. We also want the market to know what CalPERS is doing, so that we’re a first point of call on climate fund investments and co-investment opportunities. One thing worth mentioning is that we won’t have a dedicated allocation to sustainable investments (SI). Rather, there’s going to be this $100 billion allocation to the strategy that will be co-implemented by both our SI team and the asset classes. This way we leverage the decades of experience of the asset classes and their in-depth relationships with asset managers, and we combine that with the specialized climate investment skill set of the SI team.

Eccles: Why are you handling things that way – of working across asset classes to invest the $100 billion?

Cashion: I think this makes more sense for us because it allows us to achieve greater size and scale, and there’s no reason to recreate, say, a private equity group within sustainable investments. We think this is one of the things that sets CalPERS apart compared to some other asset owners.

Eccles: Like many investors and businesses, CalPERS pledged to be net zero by 2050. What does it mean to be a net zero pension fund? Also, what does it mean for climate change?

Cashion: Net zero is very important, but also very challenging. You know all the experts and scientists tell us that we need to be net zero by 2050 to avoid really serious climate risk and damage. So it’s critically important that institutional investors be on such a pathway. But as a global investor with over half a trillion in assets, you know we can’t go that much faster than the economy, so that is a constraint.

At the same time, we believe our $100 Billion Climate Action Plan will decarbonize our portfolio at a faster rate and also contribute to decarbonizing the overall economy, especially with transition investments. One goal of our plan is to cut the emissions intensity of the CalPERS portfolio in half by 2030.

In addition, there’s the work we are doing from a top-down policy/advocacy level to promote more climate disclosures by companies. As a founding member of Climate Action 100+, CalPERS has been very proactive and engaging with the highest emitters, which is also a key piece of the puzzle.

I was at a wedding in the Hamptons at Henry Ford’s oceanfront estate… Had to take advantage for some photos. JUNE 2017

Eccles: You had an update to your climate action plan in July that featured a new investment. What can you tell us?

Cashion: In July we announced a large-scale commitment on the public equity side, a $5 billion investment into a Climate Transition Index that CalPERS developed alongside the Financial Times Stock Exchange (FTSE).

The thesis here is we want to underweight high-emitters who do not have a plan to transition to low-carbon, while overweighting high-emitters with a plan, and also climate solution providers. By doing so, we feel we can insulate our portfolio from some of the transition risk, while at the same time benefiting from the growth in climate-related solution industries.

On the private side. We also announced, nearly $5 billion in investments, including some advanced pipeline deals. The deals cover both infrastructure and private equity. What we’re noticing is that the scale of infrastructure investments, perhaps not surprisingly, is very high. In terms of the number of investments, private equity has the lead in that case.

Eccles: Another element to all of this is your work in stewardship and engagement, which not everyone feels is an effective strategy. What’s is your take on this?

Cashion: CalPERS has been a leader in stewardship and engagement work for many years. We have a dedicated team that that oversees this, and there’s over 400 engagements per year, covering more than half of the $210 billion in the public equity portfolio. A key component of that engagement, particularly for high emitters, is to engage with them and discuss what their climate plans are in terms of managing climate risk.

Investors like pension funds need information in order to make good decisions on behalf of their members. We really view this as an integral part of making the portfolio more resilient by making these high emitters, and companies in general, not only aware of what the risks associated with climate are, but also the investment opportunities.

It’s only been seven months since CalPERS launched its climate action plan and we feel we are already off to a very strong start.

Eccles: Thanks again for your time and good luck on investing the rest of all that capital!

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week