Earlier this year I had the pleasure of being a guest in an executive education course at Columbia Business School being taught by my good friend Professor Shivaram Rajgopal. I was on a panel with James Andrus of Franklin Templeton and Thomas Kamei (TK) of Morgan Stanley Investment Management. One of the topics we discussed was the integration of sustainability into investment decisions and funds focused on doing so. I was very interested in what TK had to say so arranged to have lunch with him when I was next in New York. I’m doing an interview with him and asked if he had suggestions of other investors doing similarly interesting work. One of the names he gave me was Julia Pei of Fidelity. TK kindly put me in touch with her. I was impressed with what she was doing as well and asked her if she’d also be willing to do an interview. She kindly agreed.

Julia Y, Pei, Equity Research Analyst and Environmental & Alternative Energy Fund Manager

Eccles: To get us started, can you tell us about your background?

Pei: Sure! My parents both have a science background, and I grew up with aspirations to be a doctor. I loved understanding how things worked. In fact, one of my favorite books when I was a child was a Chinese book called “100,000 Whys.” What was most appealing to me about being a doctor was the puzzle-solving element. Well, after a couple internships during high school and some self-reflection, I realized I don’t love blood and guts, so it was time to reimagine my career at the ripe old age of 16.

Eccles: With medicine out, how did you find finance?

I was born in China and immigrated with my parents to the U.S. when I was two. In addition to a love of science, another impact my immigrant parents had on me was an interest in personal finance. My parents used to talk about stocks at the dinner table, and as I grew older, I started to become interested in reading The Wall Street Journal and learning about economics to understand what they were discussing. Well, I guess it stuck, because I decided to go to The University of Chicago to study economics, and while I was there, I became involved with a student investment group known as The Blue Chips. That was when I started to learn how to analyze businesses and pick stocks. I realized it was actually a lot like the puzzle-solving aspect of what I imagine being a doctor is like—without the blood and guts! And interestingly enough, I was placed into the energy group of that investment organization.

Eccles: Wow, you got your start in energy early! Where did that lead you to after undergrad?

Pei: After graduating, I went to work in investment banking in the Power and Renewables Group at Credit Suisse (RIP). It was an intense but effective training ground. I’ve since learned that most people don’t find power markets to be particularly fascinating, but I’ve always thought they were so fascinating—the way utilities make money, the impact of gas prices on electricity prices, how changes in the supply stack affect intermittency and grid stability. After banking, I went to work at the family office of Sam Zell, a great investor whom we lost in the past year. I spent time on a wide range of investment opportunities in energy, industrials, business services, and even healthcare. Those experiences gave me a deep appreciation for the entire energy value chain and a bit of a value-orientation to investing.

The Fidelity Investments office at 1625 Broadway, Suite 110, Denver Colorado, USA (Photo: Alamy)

Eccles: Interesting! How did you make the transition from working at a family office to Fidelity?

Pei: Working at a family office was a great experience that exposed me to a lot and helped me narrow down my interest in public markets. I went back to business school at Wharton, and then came to work at Fidelity, first during a summer internship and then full-time after graduation. When I started, I was covering medical technology stocks on the healthcare team, picking stocks among innovative companies addressing everything from diabetes to coronary artery disease to lung cancer with tools like surgical robots and implantable devices. Analyzing these secular growth businesses was a great complement to my previous more value-oriented experience. It also gave me an appreciation for the difficulty in incentivizing behavior with short-term pain but long-term payoffs. Whether it’s exercising for long-term metabolic health or investing in renewables to reduce greenhouse gas emissions, it’s the same human tendency to discount the future!

Eccles: What a great comparison to make between health care and renewables. That brings us to what you are doing today, managing a climate solution-focused fund. Can you tell us how you decided to make that leap? Was there a personal interest in climate investing?

Pei: I started managing the Fidelity Environment and Alternative Energy Fund three years ago, first with a co-portfolio manager who has been a great mentor to me over the years, and now as a sole manager. When the opportunity came up to shift away from healthcare, I thought—and continue to think—that the fund was a really unique product in the landscape of actively managed mutual funds. I also recognized that 10 years from when I first started my career focused on power and renewables, the economics and the technology have advanced pretty far, creating an interesting environment supportive of investment—and stock picking!

The thesis behind my investment approach is as follows: The necessary transition from a high greenhouse gas-emitting world and a resource-intensive, waste-producing economy will alter GDP growth this century. Investing in the companies providing those solutions is an interesting framework for thinking about investment outperformance.

And in terms of personal interest, my connection isn’t unique. I don’t have to look far to see the effects of climate change. I do a lot of hiking in my spare time, and I recently went to visit Banff National Park in Canada with my family. One of the glaciers there has signs showing how much it has receded over time. Even for someone who knows the facts, it was pretty shocking. But I think we don’t talk enough about all of the innovative solutions. I said earlier that I like puzzles. Is there any bigger puzzle in our lifetime than this?

Eccles: Climate change is indeed a problem we need to solve. Can you put some context around the problem?

Pei: Happy to! My investment approach focuses on technologies that enable the transition to a green, clean economy. I think about it as two interrelated challenges—greenhouse gas emissions and resource use, which includes waste production. Climate science indicates that greenhouse gas emissions drive global warming, and the challenge is to remain below warming levels of 1.5C higher than pre-industrial levels. The clean transition focuses on resource scarcity and waste production. Studies show that our current rate of resource use and waste production will require three Earths by 2050.

Eccles: Can you discuss the economics around climate change and the energy transition? Solving for climate change and the energy transition sounds like a sizeable undertaking. How does that manifest in dollar terms?

Pei: The numbers are pretty staggering. Some analysts estimate that solutions focused on reduction in greenhouse gas emissions could add two to four trillion dollars to global GDP over the long-term. To put that in context, that’s like 3-5% of global GDP. This should be viewed in the context of estimates by Swiss Re, the insurance company, that global GDP is set to decline by 18% without mitigating actions.

Concept of renewable energy and sustainable resources – photo collage (Photo: iStock)

Eccles: That is all very interesting, but how does an investor get a piece of the pie? Can you describe the fund you manage, Fidelity Environment and Alternative Energy?

Pei: I’d love to! My goal is to drive outperformance by investing in enablers of the transition to a green, clean economy; “enablers” being the key word. I’m a fundamental investor and believe that stocks follow earnings and companies that can grow their earnings faster than the market should outperform. I’ve already told you that I think companies solving this challenge should see outsized investment over the next years and decades, driving growth above the overall market. In the short-term, there might be some volatility, but over the long-term, companies with durable competitive advantages—which I attempt to identify through stock selection—should be able to outperform. The market tends to underestimate the durability of a long-term secular growth there, so therein lies the opportunity.

Obviously, some technologies may be slower or faster to evolve, and they exist across a broad range of sectors or even geographies. The fund is a global fund diversified across many sectors, most heavily weighted in industrials, technology and materials but also with holdings across utilities, healthcare, consumer, and even real estate. My goal as a fund manager is to generate excess returns for shareholders through stock selection within this thematic. I think that the breadth of the fund makes for a pretty unique product within the sustainability space.

Eccles: You described a broad set of complicated and interconnected issues. How do you break that down into investable opportunities? How do you think about your investable universe?

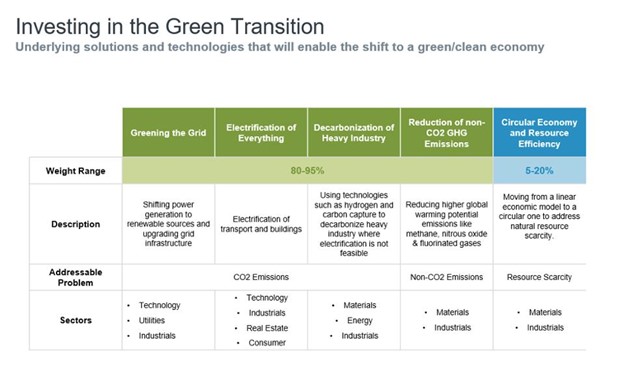

Pei: I go back to the challenges to be solved—greenhouse gas emissions and resource scarcity. I break this down into five main investment areas, neither mutually exclusive nor collectively exhaustive. The key point here is that moving to a green, clean economy requires investment across the full breadth of the economy.

The first four buckets relate to a reduction in greenhouse gas emissions (the green transition) and the last one is more about resource scarcity (the clean transition). Within the green transition, I use the sources of greenhouse gas emissions as a framework.

Investing in the Green Transition

First, it’s critical to green the grid, making electricity in greener ways and being less reliant on fossil fuels. This is likely what everyone thinks of when they think of climate technologies, but it’s not just investing in wind and solar power, although those are important. It’s also investing in the grid infrastructure and energy management tools required to handle the natural intermittency of wind and solar.

Next, we can take that electricity to power things that we currently power with fossil fuels—our homes, offices, vehicles, factories, data centers, etc. These aforementioned categories tackle about half of the sources of greenhouse gas emissions.

For processes that can’t be electrified, like heavy industrial processes, solving the carbon emissions problem may involve either capturing that carbon, or ideally, replacing that process with another fuel like hydrogen to reduce carbon emissions.

These categories all focus primarily on CO2, but there are other carbon-based molecules like methane or even chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HFCs), that research shows have an even greater impact on global warming—thousands of times the impact—in a shorter amount of time than CO2. This may entail changing agricultural practices or landfill waste production to reduce methane emissions or other innovations to address higher GWP molecules.

Finally, within the clean transition, I focus on solutions toward a circular economy, which reduces the carbon emissions from producing a single-use item from scratch, and also addresses the natural resource scarcity of making that product. Metals, for instance, are a potential resource constraint.

It’s worth noting that in each of these investment areas, I see some real opportunities that make sense economically from the customer’s perspective. It’s true that the “green” alternative doesn’t always have the lowest upfront cost, but in many cases the total cost of ownership is comparable to the fossil fuel-based choice, and likely without factoring in the cost of negative externalities associated with continued fossil fuel use.

Eccles: Thank you for bringing that to life. What is an investment opportunity you are particularly excited about investing in for the fund? Maybe one that is not often in the spotlight?

Pei: When people talk about investing in climate technologies, perhaps some of the things that come to mind are electric vehicles or solar farms. Of course those are important, but it’s worth noting that the solutions are much broader than that. Take buildings, for example. Buildings and their energy management contribute to about 15% of greenhouse gas emissions, according to the World Economic Forum. Historically, buildings were heated and cooled with natural gas. Today there are companies that I own in the portfolio that can provide electrified HVAC systems. This, combined with software-driven monitoring, can eliminate most if not all fossil fuels from buildings.

Even more interesting to me are the higher global warming potential (or GWP) emissions. Remember those CFCs and HFCs? HFCs were frequently used as refrigerants, but there are now a new class of refrigerants, called hydrofluoroolefins (HFOs), that have a negligible impact on global warming. I like to think about the solutions for these molecules as having even greater torque to the challenge of global warming and own (or have owned) companies in the portfolio with exposure to the solutions.

Eccles: Well, since we’re talking about technologies, I can’t help but bring up a controversial one. How do you think about investing in nuclear?

Pei: Yeah, nuclear is interesting! A few years ago, conversations about nuclear were mostly focused on NIMBY (“not in my back yard”) challenges and safety issues and perhaps the cost overruns that have been experienced by nuclear projects in the past. Those are still considerations, but I think we need to broaden our lens. As we add renewables to the grid, we add intermittency. To state the obvious, the sun doesn’t always shine, and the wind doesn’t always blow. This creates an increasingly unreliable grid, which means that baseload generation sources, or sources of generation that can be used reliably to fulfill the “base” or minimum amount of power required on the grid at any given time, like nuclear, become increasingly more valuable. This, combined with government incentives that create a floor for the price of nuclear production, underpins the value of nuclear.

From an investment perspective, identifying the value of a technology like nuclear early allows investors like me to take advantage of lower valuations driven by the broader market’s concerns about the challenges I started with. I’ve owned several companies within the entire nuclear supply chain including utilities that have nuclear generation. Over time, as the market has realized the value of nuclear, including the fact that it is the lowest carbon source of reliable generation, and specific proof points have assuaged concerns about safety and cost, those companies have contributed to outperformance for the fund.

HAIKOU, Aug. 10, 2023 — This photo taken on Aug. 10, 2023 shows the assembly site of the core module of the world s first commercial small modular reactor, Linglong One, in Changjiang Li Autonomous County, south China s Hainan Province. TO GO WITH China s small nuclear reactor completes core module assembly China National Nuclear Corporation/Handout via Xinhua CHINA-HAINAN-SMALL NUCLEAR REACTOR-CORE MODULE ASSEMBLY CN LiuxYiwei PUBLICATIONxNOTxINxCHN (Photo: Alamy)

Eccles: This makes sense to me. You don’t mention it, but I’m getting increasingly interested in Small Modular Reactors and know of two listed companies. I’m guessing that as an active manager you can consider these types of opportunities.

Pei: The fund does not currently have any material exposure to the public SMR companies although I have had ownership in this area in the past. I am excited about the opportunity in the long term, although think there are still questions and scaling challenges in the near term. And speaking of nuclear technologies, fusion is also making some interesting progress! Again, the near-term is difficult for direct public market investments, but I’m really encouraged by the progress in the private arena.

Eccles: Julia, you’ve been very kind with your time. Mind if I ask you one last question?

Pei: Go for it!

Eccles: Thanks! Mind telling me a bit about the fifth, blue pillar for investing in the green transition?

Pei: Thanks for asking since it’s an important part of my overall investment thesis. The “clean” side of the fund is interesting. It actually encompasses a lot of different things, but the common thread is a focus on our natural resources. We have what’s known as a linear economy—taking a natural resource, making something with it, using that product, and then discarding it. In order to avoid that “three Earths” scenario, I believe we have to reimagine our economy to what’s often referred to as a circular economy.

There are interesting plastics recycling technologies out there, for example, that extend the life of what are often single-use plastics. There are other companies that provide products made of alternative materials that are more durable and less impactful to carbon, such as resin-based building products instead of wood-based ones. As you know, trees function much better as carbon sinks if they’re in the ground than made into someone’s deck. There are many other technologies and business models focused on the sharing economy and recycling. Not all of them are profitable business models, so they may not be a current fund investment, but they’re certainly interesting areas to monitor.

Eccles: Thanks, Julia, I’ve really enjoyed this conversation and learned a lot.

Pei: I’m excited about the investment opportunities in the green transition.

Eccles: Thanks again for your time but I’d better let you get back to work doing your investing! Would love to keep in touch.

Pei: That would be great! I’ve enjoyed talking to you.

Information provided in, and presentation of, this document are for informational and educational purposes only and are not a recommendation to take any particular action, or any action at all, nor an offer or solicitation to buy or sell any securities or services presented. It is not investment advice. Fidelity does not provide legal or tax advice.

Before making any investment decisions, you should consult with your own professional advisers and take into account all of the particular facts and circumstances of your individual situation. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in these materials because they have a financial interest in them, and receive compensation, directly or indirectly, in connection with the management, distribution, and/or servicing of these products or services, including Fidelity funds, certain third-party funds and products, and certain investment service.

Investing involves risk, including risk of loss. Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss

Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk.

Sustainability factors are only some of the many factors Fidelity may consider with respect to investments, and there is no guarantee that Fidelity’s consideration of sustainability factors will enhance long-term value and financial returns

Fidelity Investments (Fidelity) is an independent company, unaffiliated with Robert Eccles. There is no form of legal partnership, agency affiliation, or similar relationship between Robert Eccles and Fidelity, nor is such a relationship created or implied by the information herein

Views expressed are as of June 27th, 2024, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the authors and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Before investing, consider the mutual fund’s investment objectives, risks, charges, and expenses. Contact Fidelity or visit i.fidelity.com for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.

FIAM LLC is a registered investment adviser, and Fidelity Institutional Asset Management Trust Company, a New Hampshire trust company. Both are Fidelity Investments companies. FIAM products and services are presented by Fidelity Distributors Company LLC (FDC LLC), Fidelity Brokerage Services, LLC, Member NYSE, SIPC, or Fidelity Invesments® each a non-exclusive financial intermediary that is affiliated with FMTC and compensated for such services.

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week