I met Rini Greenfield in 2018 at a wedding in Edinburgh for the daughter of a mutual friend. Rini has been close with the family since she was a child and I’ve known them for over 25 years. Rini and I kept in touch a bit and then reconnected a few months ago when she was visiting our friend on a holiday. It was great to get caught up and learn more about what she is doing to help transform the world of food and agriculture through technology investments as the Founding Managing Partner of Rethink Food. I think what she is doing is fascinating and important so I asked her if she’d be willing to do an interview with me so I could spread the word a bit. She kindly agreed.

Rini Greenfield, Founding Managing Partner, Rethink Food

Eccles: In many ways you’re a classic American success story. Mind telling me a little bit about your childhood?

Greenfield: I was born and raised in Queens. My parents immigrated to the U.S. from India as students with $300 in their pockets. My father was a computer scientist working on mainframes, which are now called data centers, and my mother worked in finance. At the age of 14, I was selected to attend one of the most selective public schools in the country, Stuyvesant High School in New York City. Being immersed in that extremely competitive, hard-working environment served as the basis for my driven work ethic and opened endless doors to opportunities for me.

Eccles: You know I grew up in Colorado and went to a high school that was subpar at best. When I went to MIT for college, I found a number of kids there from Stuyvesant. They were so much better educated than me that I was terrified! Where did you go to college?

Greenfield: I moved across the country to attend undergrad at UC Berkeley.

Eccles: Ah, the old “get as far away from your parents as you can move, right 🐥?”

Greenfield: Yes! But it was more than that. Berkeley is very strong in the areas that were of interest to me. I have always had a deep interest in science, so I went in with the intention of studying biology but quickly found my calling in economics instead. It was around that time that the Acumen Fund was founded, and microfinance was talked about in mainstream media, I became deeply curious about how capitalism could lead to doing well and doing good. But I knew that to learn more, I would need to earn a proper education on Wall Street. I got recruited as a semiconductor analyst out of college where I ended up landing my connection to a hedge fund, Weiss Multi-Strategy Advisors, which ultimately shaped the trajectory of my career.

Eccles: Interesting evolution. What led you from working in a hedge fund to founding a VC firm?

Greenfield: I started my career in public markets with Weiss investing in technology companies which is how I learned to analyze a company, industry, and management. For me, the ability to access this information on so many different companies was like a gold mine. I was eager to learn a lot and quickly, and I became fascinated by big data. I was good at stock picking and did well while still quite young—so much so that my parents questioned if I was doing something illegal! I worked hard and it paid off. I was the only female investor, putting in 80-hour weeks, and did so for eight years.

Eccles: Just guessing but you probably made more money in those eight years than I’ve made in my life as an academic….

Greenfield: For sure, Bob, but no whining. You were an adult when you chose to become a professor and as an MIT grad, I hope you understood the economic consequences of that.

Eccles: Fair point! But you need to help me understand why you’d leave a successful and lucrative career in a hedge fund to go into the risky venture of starting a VC fund which, by definition, is all about very risky events.

Greenfield: Looking back, it was a pretty natural evolution. I left Weiss in 2013 to join Tiger Management. That year, I started thinking outside the norm of fundamental investing research. Together with my then co-founder, a brilliant computer scientist, we built a data analytics platform to help make more accurate long-term investments. We started to put money to work at Tiger, and Adaptive Management was born. Adaptive really ignited my interest in early innovation. After it sold, I led investments for a large family office, which is where I developed my passion for food technology. I was there for a little over a year before realizing I wanted to create my own destiny and focus my energies where I thought the opportunity was greatest. That’s what brought me to building an investment fund focused on food and agriculture because that’s where I thought I could have a high level of impact.

Eccles: Good for you to follow your passion but why food and why VC?

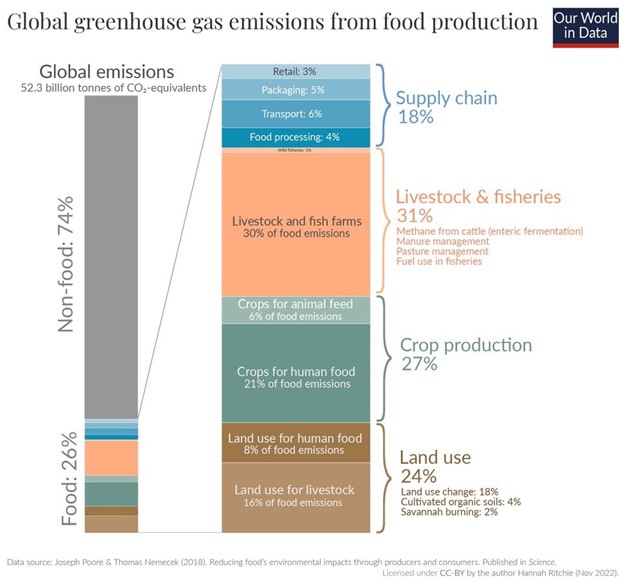

Greenfield: My first exposure to investing with an impact-lens was when I was working at the large family office. When we met impact funds to talk about climate change, they would pull up a graph of top greenhouse gas contributors, point to energy and mobility, and ignore the nearly one-third of the problem that was attributable to our food system. This happened time after time, and I wanted to know why.

Global Greenhouse Gas Emissions from Food Production DATA SOURCE: JOSEPH POORE & THOMAS NEMECK (2018). REDUCING FOOD’S ENVIRONMENTAL IMPACTS THROUGH PRODUCERS AND CONSUMERS. PUBLISHED IN SCIENCE. LICENSED UNDER CC-BY BY RETHINK FOOD (NOV. 2023)

Eccles: How did you go about that?

Greenfield: In 2019, I began exploring the food system to understand whether it was investable and what, if any, opportunity existed there. I learned that while it wasn’t always investable, there were shifting tides in consumption patterns that showed promise for the sector, with companies like Beyond Meat going public. So naturally, I was hooked. But I knew that in order to properly break into the world of food, I needed a partner with experience in the industry. In 2020, I brought in my Co-Managing Partner Brad Jakeman, former President of Global Beverages at PepsiCo. Brad and I invested together for a year before bringing Rethink Food to market in 2021.

Eccles: Tell me a bit more about why you are pursuing food and agriculture specifically.

Greenfield: The cost of food goes beyond the amount we spend on groceries each week. Our food system has significant hidden costs—its effects on the environment, our health, and society. Those are the three pillars we focus on addressing through our investments at Rethink Food.

Eccles: That’s great. Let’s go into more detail on those pillars. Let’s start with the environment.

Greenfield: We often say if we want to combat climate change, we must look at what is on our plates (literally) and how it got there. The global food system is a massive contributor to climate change, but it remains a relatively untapped focus area compared to energy and mobility. The cost of our food system on the environment and biodiversity is ~$900 billion per year. The demand for food is growing, while at the same time supply faces constraints in land and farming inputs. Not only will our planet have a projected two billion more mouths to feed by 2050, feeding them under our existing systems would require cultivating a land mass 2x the size of India. Our challenge is that our planet cannot afford to support the increase in demand under our existing practices.

Eccles: Wow! Sounds like a pretty bad situation and one that’s only getting worse. What about health?

Greenfield: The food system has inherently burdened the healthcare system. A vast majority of modern diets are becoming nutritionally vapid with toxic levels of sugar, fat, and processing; and rates of diet-related diseases like obesity, diabetes, and cardiovascular problems remain alarmingly high. Only 6.8% of American adults have ideal cardiometabolic health and poor diet is responsible for more deaths globally than tobacco. On the other hand, pollutants and chemicals from our production, farming, and agriculture practices have serious repercussions to our health in addition to the environment. In fact, the Rockefeller Foundation reports that the health costs associated with the negative impacts of the food system from poor diet, pollution, and food insecurity total ~$1.1 trillion. That’s equal to the cost the U.S. pays for food itself. Still, nutritious, whole, protein-rich foods are increasingly out of reach and budget for many people.

Eccles: These are staggering and depressing numbers so might as well hear more. What is the impact of the food system’s impact on society?

Greenfield: There’s a massive problem with access to affordable and healthy food sources, which directly impacts the burden to our healthcare systems. In the U.S. alone, 17.1 million people live in low-income and low-access areas where they are more than one or even 20 miles from a supermarket, making it difficult for them to maintain a healthy diet. Our challenge is to deliver healthy and ethically-sourced food to the masses, by making production processes more effective and reducing the enormous waste that is built into the system.

Collectively, these are not just big problems for people and the planet, but these are big opportunities for new companies to develop novel and efficient technologies, which is what we are trying to accomplish at Rethink Food.

Eccles: Ok, so we have talked about the problem, now let’s dive into the opportunity. Why is VC a good approach to addressing it?

Greenfield: Food remains a widely underinvested sector. Food accounts for about 14% of global GDP. Only 10% of private equity and venture capital investments go to climate tech, and of that, less than 10% goes to food and agriculture, despite it accounting for one third of the climate problem. Food and agriculture is an opportunity to invest in innovators in a large market, while everyone else is chasing the same investments in alternative energy and mobility.

There’s also a much-needed digital transformation happening in the food system. Chemical fertilizer increased yields by 60% a century ago and it’s estimated that half the world population is sustained by food produced with synthetic fertilizer. But with all the technological innovation we’ve had in the last few decades, there has been little innovation of such scale in food and agriculture. And venture capital is the best way to invest in innovation.

Eccles: Can you share more about your investment strategy at Rethink Food?

Greenfield: As a venture fund, with a mission to do well and do good, we identified the areas we believe are both the biggest levers in climate and nutrition and have the greatest potential for commercial scale. The six subsectors we focus on are:

- No/Low Waste Tech

- Ingredient Technology

- AgTech & Precision Farming

- Sustainable Distribution

- Food As Medicine

- Packaging Technology

Rethink Food’s Six Sectors of Focus

Eccles: Please share an example of two of innovations Rethink Food has invested in within these subsectors.

Greenfield: Yes, of course. The first example I’ll share is an investment we made in our AgTech & Precision Farming sector, Planet FWD. Planet FWD is an AI-powered decarbonization platform to accelerate a food and beverage brand’s path to net zero. This technology is particularly relevant right now as California recently passed the California Climate Disclosure Requirement, requiring major corporations to report on carbon emissions, which experts in the field say will set the standard for the rest of the nation. By partnering with brands to calculate their greenhouse gas emissions, identify the drivers of their supply chain emissions, and reduce their Scope 3 emissions, Planet FWD is more uniquely positioned than ever to help companies prepare accordingly.

Eccles: Great example! I know you’re busy and need to raise a fund, but mind sharing one more with me?

Greenfield: Happy to do so, Bob, but glad you recognize that unlike you I’m trying to start a business! Another example I’ll share is in our Food As Medicine subsector, Brightseed. Brightseed is an AI-driven data and biosciences company that finds compounds in nature that can benefit human health. As a society, we know surprisingly little about the chemical compounds plants produce. In fact, only one percent of bioactives in nature have been mapped to human biology, leaving 99% left to be discovered. Brightseed has analyzed thousands of plant compounds in search of bioactives that have underlying health benefits.

Eccles What’s next for Rethink Food?

Greenfield: Rethink Food is steadily expanding its horizons. We have built a firm, with operators and investors, to accelerate the digital transformation of food and agriculture. We are honored to have deeply knowledgeable investors like the former CEOs of PepsiCo, Tyson, and Chipotle, as well as large family offices that are deeply knowledgeable about food systems and technology. They are involved and passionate collaborators that work closely with us and our portfolio companies.

Logo for Rethink Food

Eccles Thank you for your time, Rini. I think Rethink Food will be on the right side of history, it’s only a matter of time.

Greenfield: Thank you, Bob! I really appreciate the opportunity. You’ve been around longer than most, so you should know a thing or two about history 😊. In all seriousness, we know that food is the next frontier in combating climate change.

SUBSCRIBE TO OUR NEWSLETTER

Subscribe our newsletter to receive the latest news, articles and exclusive podcasts every week